Here’s everything you need to know to get an employee advocacy program up and running.

↓

Here’s everything you need to know to get an employee advocacy program up and running.

↓

Today, employee advocacy is fast becoming the go-to strategy for amplifying brand reach and generating bigger audiences on social.

Why?

Well, for marketers, it’s getting harder to use ads and other conventional marketing tactics to create visibility, nurture prospects, and drive revenue.

Cost-per-acquisition (CPA) is going up, audiences are pickier with the content they consume, and competitors are crowding up the space. Don’t get us wrong! The tried-and-true marketing tactics still work, but you can’t lean on them alone.

That’s why employee advocacy – and brand advocacy as a whole – is an amazing marketing asset, especially in today’s environment where trust is valuable currency.

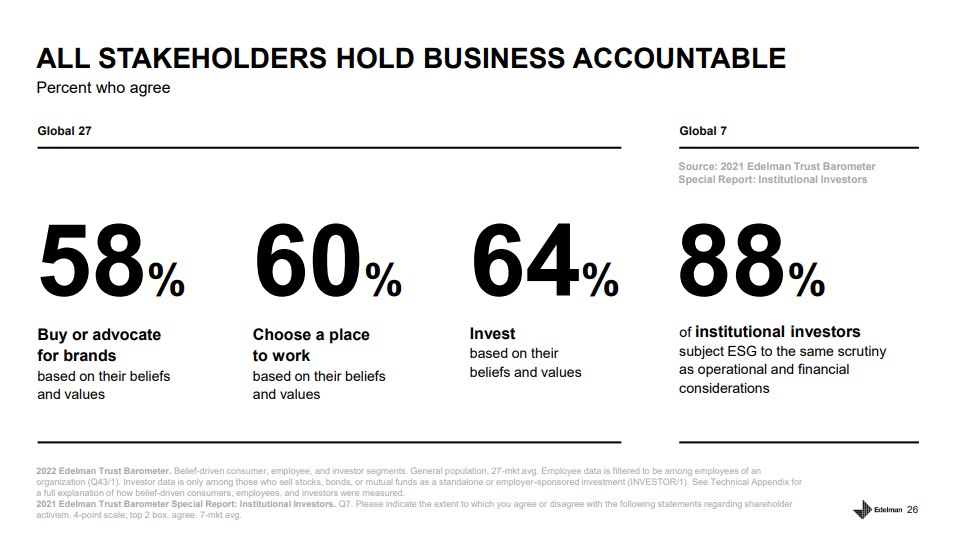

Basically, audiences trust recommendations from family, friends, and peers – i.e., people. For people, authenticity and relatability matters. The goal of employee advocacy is to position your employees as the people audiences listen to and follow.

Not only that, but audiences are increasingly expecting brands to align with their own values and beliefs. Basically, employee advocacy plays a huge role in showing potential customers, partners and new hires that value alignment.

Your employee advocacy program needs to empower your employees to create authentic links with their audiences. But how do you achieve that?

You need to position your employees as thought leaders, experts, and credible voices. You must equip your employees with the tools they need to get each of your target social media platforms right (i.e., understand the algorithm, best practices, etc).

In this guide, we’re leveraging our experience supporting employee advocacy programs across dozens of industries to give you a playbook to success.

Table of Contents:

Employee advocacy is the promotion of a brand through its employees. It happens through a variety of ways, but the most common strategy is through social media advocacy.

On the surface, employee advocacy on social media involves employees spreading brand awareness on platforms like LinkedIn, Facebook, Twitter and others. They can share company news, amplify a job posting, or re-share social media posts from your official channel.

But we don’t want to reduce employee advocacy to just another content distribution platform for social media. We don’t want to treat our employees as posting and sharing bots either.

Rather, your employees are active agents who can make a difference for your brand if they’re informed, engaged, and involved throughout your employee advocacy program.

In other words, a big piece of employee advocacy is to empower the employee voice. This is a critical part to helping them build trust and authenticity with their audiences.

Employee-generated content (EGC), for example, is a great way to drive that authenticity as it results in content that comes directly from your employees. Likewise, getting employee input on the content you’re creating is also key to ensure it’s stuff they can personally speak to.

Overall, employee advocacy isn’t about giving your employees to share content over and over again. Rather, think about what it’ll take for your employees to build credibility with their audiences. You need to look at this from their perspective and make sure you’re closely working with them.

An employee advocate is an active agent who helps amplify your brand on social media through their networks. They build trust with their audiences and, in turn, that trust helps your brand get in front of those audiences in a positive light.

A good starting point to finding employee advocates is to look for employees who are visible and proactively engaged with your brand.

These are folks who already post or engage your content on social media. They attend all of your company’s events. You’ll also find them volunteering their time for company initiatives.

In fact, as many as 21% of employees already do positive actions for their employer (Weber Shandwick & KRC Research). In all likelihood, your company already has great potential for employee advocacy as you have people who are ready for it.

Influential employee advocates have a number of common traits, such as large networks of relevant audiences, consistent content sharing, and ability to engage their connections. Check out our report on employee advocates to learn more.

Employee advocacy is important because it helps amplify brand reach and engage employees.

According to a study, employee advocacy helps fuel sales growth, boost productivity through engagement, and supports brand reputation-building and brand management.

With the right employee advocacy strategy, you can generate benefits for both your organization and your employees.

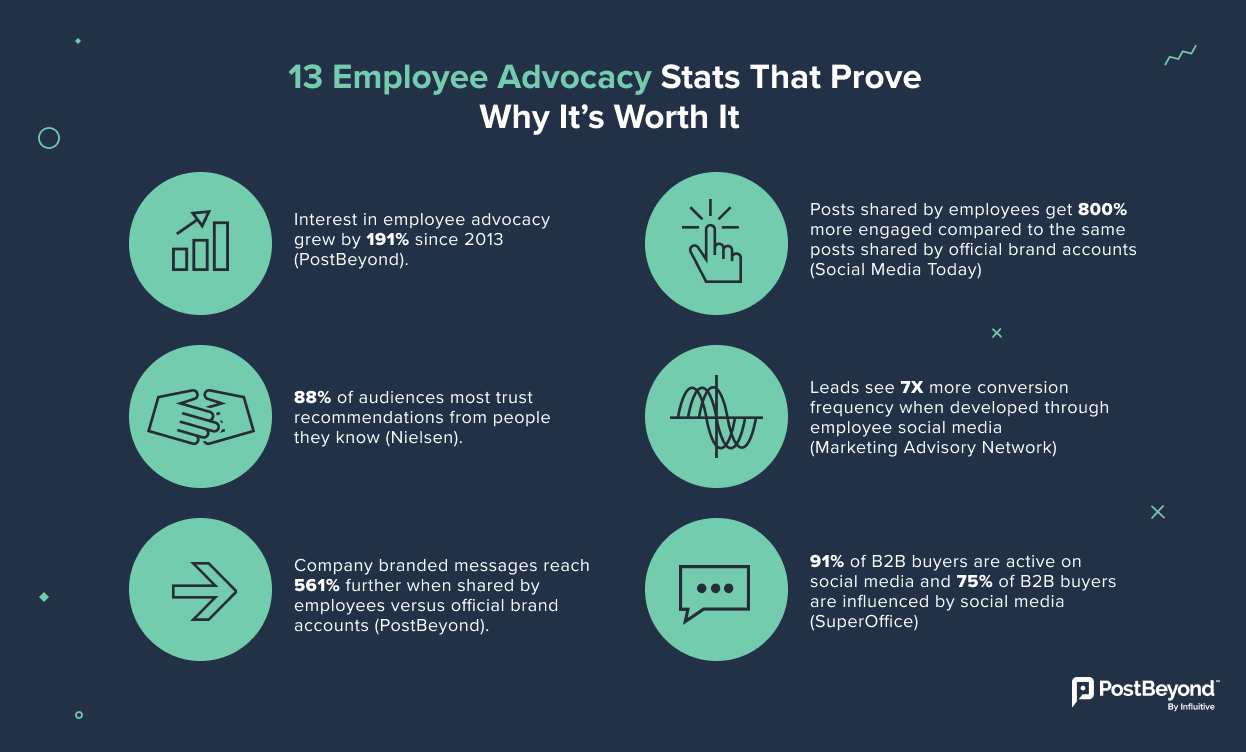

Your employees carry authenticity and relatability with your audiences. When an employee, for example, highlights how they loved your new hire onboarding experience, their audiences will resonate with your employee’s perspectives. In fact, your employee’s voice in these contexts carry more weight compared to messages that come from your official brand accounts.

According to the Edelman Trust Barometer, brand promotion through an employee is 2X likelier to be trusted by audiences than from a CEO. Your employees carry trust with their audiences in a variety of ways. They’re sources for insights, role models, and more, so their words count.

Employees have on average 10X more followers than a brand’s official social media accounts. If you strictly rely on your official accounts, you’re leaving a lot of potential reach on the table.

Employee advocacy is an effective way of driving more employee engagement. With the right strategy, you can empower employee voices and help them shine in front of their peers. This is a great way to make them interested in your brand’s activities. In turn, employee engagement helps drive more productivity, greater talent retention, and a more vibrant company culture.

Employee advocacy programs are also a powerful way to drive more awareness – both within and outside of the company – of your organization’s culture. A stronger culture helps reinforce employee loyalty and, in turn, help with talent retention.

Your sales team is probably active on social media already. Your employee advocacy program could elevate them into becoming experts who can solve their prospects’ problems.

Basically, when a prospect starts engaging with your brand through your sales team, they’ll start getting tangible value right from the start. This is an amazing way to start a brand relationship – and it makes the rest of the nurturing and closing process much easier.

You can build a massive content pipeline when you integrate EGC into your employee advocacy program. In fact, EGC is super valuable because it comes directly from the thoughts and voices of your employees. So, EGC carries authenticity with audiences, which is what you want to have in spades when driving a content marketing strategy.

The social media reach you generate through employee advocacy is organic. When it takes off, you can save a lot of money on your marketing spend when trying to reach more audiences.

Earned media value (EMV) is a good starting point to gauging the value of employee advocacy.

Employee advocacy helps you get your company’s blogs, ebooks, white papers, webinars and other thought leadership content in front of more people. Likewise, when you center your thought leadership on your employees by featuring them and their insights, they elevate as professionals.

Employee advocacy gives your employees the benefit of growing their networks. When you position them as thought leaders and experts, you help them drive more audience reach. In turn, they connect with more of their peers and, potentially, other executives and leaders.

Your employees get the chance to showcase their knowledge and expertise.

You can facilitate this in a variety of ways. For example, you can provide content that your employees can speak to through their own comments and analysis.

You could also feature them in branded content, such as blogs, webinars, ebooks, podcasts and more. Your employees become a reference source for others when it comes to relevant industry information.

An employee advocacy program is also a good way to upskill your employees on social media. They can drive more reach and visibility for themselves. You can do this by providing guides or playbooks detailing best practices, tips and examples for best practices on social.

When your employees emerge as thought leaders and impactful voices, they, basically, “look good” in front of their peers and networks. This can help them climb vertically in their careers and create new opportunities for themselves.

Employee advocacy also gives your employees a voice to talk about the values and culture that’s important to them. In fact, giving them a platform to talk about what it’s like working for your company and how you align with them is empowering.

Before going into these steps, we recommend you start by running a pilot program first. You don’t need to jump into a full-scale employee advocacy program from the onset.

It’s key to understand that employee advocacy is something that happens because of a positive and engaged workplace. Your employees will advocate for your brand because of the workplace experience they’re already getting.

An employee advocacy study found that employees become advocates when:

It might feel like taking a step back, but it’s a necessary one. Your workplace is a key foundation for your employee advocacy goals. If you want to reach a point where employees are positively talking about your organization, you need to explore issues like:

When you work on these aspects, you can start improving employee engagement in your company. In fact, a Gallup study found that engaged employees lead to sharp drops in things like absenteeism, turnover, shrinkage, and safety incidents on the one hand, and improvements in customer loyalty and engagement, productivity, and profitability on the other hand.

When your employees are engaged and supportive of your company, then you’ve got a really good basis to start an employee advocacy program.

As William Craig put it, company culture is “something that is pre-existing in your company’s genetic code.” Your company culture is your brand’s personality and it shapes every aspect of your organization, e.g., decision-making and how others (e.g., employees and customers) view your brand.

For employee advocacy to work, you need a company culture that strives for a dynamic social presence, innovation, and employee engagement. If you’re interested in learning about how to build company culture, check out our blog here.

You need to set the “why” of your employee advocacy program very early on. The goals you decide on will shape the rest of your strategy. It’s perfectly fine to have multiple goals (if not a must), but remember, each goal requires its own ingredients for it to succeed.

Common employee advocacy goals include:

Next, set KPIs that will help you measure the impact of your employee advocacy program. To gauge your advocacy impact, the following metrics are a good starting point:

To learn how you can calculate and use these metrics for your program, then check out our guide on employee advocacy metrics here.

Next, create (or update) your company’s social media policy.

This is a guidebook or code-of-conduct for your employees when they post on social, be it as part of their job or in their personal capacity.

A social media policy is a key part of every employee advocacy program. One of the biggest blockers to employee advocacy is fear. Your employees might be afraid that their content can get them in trouble with the company.

So, a social media policy is an effective way to clear up misconceptions. You can set guardrails to show employees the content and activities they should avoid.

Of course, you don’t want to make your policy so restrictive that it deflates interest in social.

Rather, build your social media policy like a runway. Think of ways to empower your employees to take off and thrive on social, but also avoid hazards that can set them off course.

Check out our guide on how to build an effective social media policy for more information and some great examples from many industries.

Depending on your industry, you may have to think about additional requirements, such as FINRA in the finance sector.

To launch successfully, you’ll need buy-in from across your organization, and at every level.

Leadership buy-in is critical.

Not only is it an issue of getting the necessary approvals and resources, but executives and leaders also set the tone for the rest of the company.

In our experience, the employee advocacy programs that do the best are the ones that are fully supported and championed by the leadership, especially CEOs and Presidents.

Executives who champion employee advocacy and enthusiastically participate in the program help drive up adoption rates. The more they take part, the more the program grows.

You can convince executives to join by highlighting how executive visibility is becoming the norm. In fact, Edelman’s 2022 Trust Barometer study found 81% of people expect CEOs to be visible when discussing their companies.

For more information on how to activate executives for employee advocacy, check out our complete guide.

You also need to get departmental heads and managers on board too. Like executive leaders, managers can also set the tone for their immediate teams.

The key is to understand that each department also has its own KPIs. You should work to link employee advocacy to those KPIs. That link will motivate those teams to help you out.

For example, you can show the sales team how employee advocacy can help them close more leads. When that link is clear, you’ll see the managers integrate employee advocacy as part of their team’s standard work. That’s a great foundation to work from.

Start by reaching out to each department head and get a handle on their goals. Connect your advocacy to their goals and you’ll get their buy-in.

To get employee buy-in, focus on answering the question, “What’s in it for me?”

Basically, you need to highlight the value of growing their networks, building personal branding, elevating their thought leadership, and supporting their career growth.

You need to spend some time gauging each department to understand who has the most to gain from employee advocacy. You’ll want to start with those who have the greatest interest – both in their personal capacity and as part of their work – to engage in social.

Building on the last point, start with the teams that have the most to gain out of being active on social media. In our experience, we found that the marketing, HR, customer success, and sales teams are a good starting point.

Once you have your initial employee advocacy group, create a plan to roll out your employee advocacy program. This is the brasstracks process of taking your program idea to reality.

We have a detailed A-Z guide on how to roll out your employee advocacy program here.

But for a high-level look, here’s what you need to do:

First, identify the channels you can use to make people aware of the employee advocacy program. This can include email, Slack, Teams, town halls, team sync-ups, etc.

Second, set up channels or hubs where employee advocates can get content to share, and to give content suggestions to your admins.

Third, organize time for coaching your team on the employee advocacy program. Help your employees understand the goals, drive visibility towards the value of social media, and set up workshops to train your advocates on the program.

You should also have a change management strategy in place. Does employee advocacy in your organization require a new role? Will it affect your current workflows?

There’s quite a bit at play, so we recommend checking out the full guide here.

Content is a critical part of employee advocacy. In fact, most already have a treasure trove of blogs, ebooks and other assets they can start pushing right away.

But we don’t want to limit our focus to solely branded content.

Remember, your employee advocates aren’t just a delivery vehicle or posting bots on social media. Rather, they’re active participants who should have a voice in your program.

In fact, if your employees don’t resonate with your content, then they’ll have trouble being able to speak to it or elevate it. In turn, your employee advocacy program could sputter.

The key here is to build a healthy content mix of branded, unbranded, third-party, and EGC assets. Not only that, but invite suggestions from your employee advocates!

Leveraging your branded content – like blogs, ebooks, webinars, etc – is a good start. But to build a healthy employee advocacy content mix, here’s what you can do:

You can learn more about building an employee advocacy content pipeline here.

It’s important to keep your existing employee advocates engaged so that it grows. Leverage things like leaderboards and rankings to drive competition, for example. Think about giving rewards (like gift cards) for seasoned employee advocates and your top performers.

You should also think about attracting advocates by recognizing new and previously dormant advocates. For example, create awards for those who cross early milestones. You should also recognize those who make high-effort contributions (like creating videos), even if they’re not as active or frequent in their advocacy.

Your employees are also key stakeholders. It’s important to have a pulse on how they’re feeling, both in terms of the employee advocacy program, and in general.

Remember, if employee engagement starts slipping, it could hurt your brand advocacy program.

That said, employee engagement involves more than just you. This returns to one of our earlier steps where you need leadership/executive and cross-departmental buy-in.

Try steering your employee advocacy program to focus on the employee. Put the employee at the center in as many areas as possible. So, center them in the content you create and in the strategies you build when it comes to sharing and commenting.

The point is to ensure you create as much employee buy-in as possible in the program as that will help fuel engagement, growth, and success.

Though you’re just starting, it’s a good idea to have a vision and roadmap for long-term growth.

Think of ways to continually grow your employee advocacy program. Plan for when that growth does catch on and necessitate a bigger program.

Here’s what you can do:

Where possible, start following larger employee advocacy programs of other companies. This will give you a feel of how they’re managing their scale.

For example, some companies segment their employee advocacy programs based on region, business division, and other categories.

Others start looking at different dedicated employee advocacy tools or software to manage a larger number of seats. Some tools provide automation for certain tasks (like adding content to the publishing queue of busy advocates, uploading and sharing native videos, etc) that make it easier for admins and advocates alike.

It can be difficult to get a real grasp of what other companies are doing. If you’re in the market for an employee advocacy platform vendor, look for one that can link you up to a community of other employee advocacy program admins. This way, you’ll enter a community of like-minded marketers to exchange insights and get more visibility on where to take your program next.

Dedicate some time to champion employee advocacy in your company. Build reports of your program’s performance. Continually establish how you’re supporting departmental KPIs and your company’s overarching goals.

One effective way to grow your employee advocacy program is to work with your HR team. Get them to integrate employee advocacy in the employee onboarding process. Each time someone joins the company, they’ll see the employee advocacy program as a natural part of their work.

Finally, dedicate time and resources to making sure your employee advocacy program stays ahead. Don’t stick to the styles you’re comfortable with or avoid styles that you are not familiar with.

The social media landscape is constantly changing. People change, platforms change, and expectations change. For example, Laura Erdem from Dreamdata recommends you consider using TikTok-style videos on LinkedIn. That’s a huge jump from webinars, but new stuff could resonate with your employee advocates and empower them to stand out from their peers.

Scale Your Employee Advocacy Program With PostBeyond